Greatest Ally

About UFA

How It Works

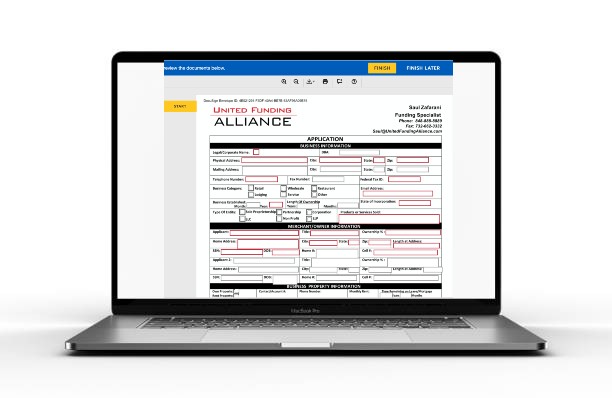

Apply online in just minutes!

Our application process is fast and simple. No need to run around putting together unnecessary documentation.

Get your approval the same day!

Our team will review and underwrite your file to customize and build an approval designed specifically for your cash flow.

Receive your funding in as little as 24 hours!

Once you decide your approval works for you, we will complete the funding process with you and make sure the funds are in your account right away.

What We’re Offering

SBA - PPP

With interest rates as low as 1% and opportunities to get the loan forgiven, the PPP loan can be what saves your business from going under in these unprecedented times.

Term Loans

A term loan can allow you to take advantage of opportunities quickly and easily, such as purchasing quick-turnaround inventory and longer-term needs as well, like opening a new business location across town.

Lines Of Credit

Having access to a business line of credit can be a tremendous asset for a small business.

Debt Consolidation

Debt consolidation can be used to pay off and simplify existing debt by consolidating multiple payments into a single payment.

Merchant Cash Advance

A history of bad credit can prevent you from obtaining funding from a traditional lending source.

Real Estate Secured Business Loans

Using real estate to back your loan will save you thousands of dollars compared to taking out a conventional business loan.

© All Copyright 2022 by United Funding Alliance LLC.